How the Dollar and Euro monopolies destroyed the real market economy. And what Hayek told about the need for competing currencies.

How the Dollar and Euro monopolies destroyed the real market economy. And what Hayek told about the need for competing currencies.

8,299 views

Introduction – How the Dollar and Euro monopolies destroyed the real market economy

Introduction – How the Dollar and Euro monopolies destroyed the real market economy

The recent global financial turmoil with heavy losses on global stock markets and currency devaluations are symptoms of deep-rooted fundamental problems in the global financial system. I am bound to baffle many when I venture to tell that the root-cause to these extraordinary woes is not too much market but too little. To the point, in my opinion the global financial markets – and therefore the broader economy – has been destroyed by the USA and EU exercising worldwide monopoly abuse of their respective currencies. The US dollar hegemony constitutes a monopoly on a global scale, whereas the euro has established a regional monopoly with global repercussions. Moreover, the Western central banks collude in upholding their monopolies. This abuse of the currency monopolies have destroyed the system of market economy in the USA and EU.

With these monopoly currencies, the US government and the EU regime have in essence abandoned a market-oriented governance and replaced it with a queer form of a centrally planned economy. In this new form of Western planned economy, they do not strive to set the prices of each and all goods and services separately – as it was in the planned economy of the Soviet Union – instead they fix the price of the most important of all goods, namely the price of money, by administratively decreeing the interest rates without regard to the market mechanisms. In a real market economy, it would never have been possible to press by fiat the interest rates down to zero without the other components of a financial system – currency exchange values, inflation, risk premiums – reacting in different directions.

It is the Western central bank regulations and other means of central planning of the economy and all life by the Western governments that have led to unfair practices and outright corruption which favors a few well-connected banks, corporations and individuals. There is wide and motivated outrage for how the Western central banks have been aiding banks and publicly listed corporations leading to spectacular unearned personal gains by the bankers and executives in form of bonuses, stock options and capital gains through central bank financed stock buybacks. This is true, but people should realize that this is not the free market system; these are symptoms of a corrupt centrally planned system with monopoly currencies. In a real free market, no central bank would possess the capability of rigging the interest rates, debt levels and stock markets the way it now happens in the centrally planned Western economies.

After a decade of debt-fueled superficial growth, this noxious monopoly abuse has reached its terminal phase where all the harmful effects have cumulated to breaking point with problems piling up on all fronts: unprecedented levels of debt of governments, corporations and households; practical zero-growth in the West despite massive government stimulus in form of budget deficits and money printing (quantitative easing); real unemployment of catastrophic proportions (belittled through artful statistical accounting tricks); diminishing global trade and investments; stock and bond market bubbles, etc.

As a consequence of all these severe problems, the Western economies are heading for a total collapse. The monopoly currencies will increasingly lose their credibility and with that the central banks their capability to prop them up with manipulative money supply and zero-interest financing. The system now risks going down in one big bang after years of creeping decline. A great depression of epic proportions will follow with a wave of bankruptcies wiping-out of asset values, bringing great unemployment and social upheavals. Personally, I believe that this will happen within ten years, perhaps as soon as five, or who knows, maybe even any day now?

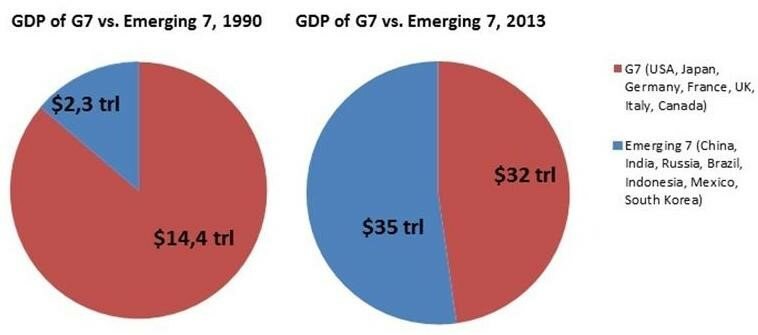

The currency monopolies represent in fact the last remnants of the world hegemony of the Western powers as they are fast losing all the competitive advantages they have had over the rest of the world during the last few centuries and their colonial power. There are fundamental reasons for the decline of the West. Those countries have simply lost their competitive advantages relative to the rest of the world. The Western system used to be superior over the rest of the world in a number of fundamental areas: democracy, market economy, freedom of press, education, technology, rule-of-law, banking and finance. Now these phenomena have been equally embraced or even superseded by the bulk of the emerging world. At the same time the West has had to relinquish some of its colonial powers. Therefore the emerging world will inevitably catch up with the West in economic strength and the accompanying power. Giving the balance in their favor in world population, the West risks being marginalized, a process which is going on with breathtaking rapidity.

In this study, we discuss the background and causes of this impending economic catastrophe, and the possibilities to thwart it, to the extent there is any way still to do it. We have divided the discussion into sections under these subheadings:

- The Fed and ECB have through abuse of the dollar’s and euro’s market dominance destroyed the market economy

- The zero-rate market abuse is a pyramid scheme about to bust

- All economic and political monopolies will vanish sooner or later

- With perpetual zero-rates, the Western central banks have lost their capacity to regulate market through interest

- Massive new debt hides years of negative GDP growth in EU and USA

- Central bank orchestrated debt binge – Global debt up from $87 trillion to $199 trillion between 2000 and 2014 (Q2)

- Western countries now practically centrally planned economies

- Currency colonialism is not good for anybody, not even USA and EU proper

- Western economies of today are not liberal free markets; “neoliberal” = “neo-Bolshevik”

- Ditching market economy in favor of central planning led to market abuse and corruption

- A real market economy is a homeostatic self-organizing system

- Drachma would have protected Greece against the catastrophe

- The rise of the US dollar hegemony

- Unfair benefits through monopoly abuse

- Western central banks acting in collusion

- Friedrich Hayek and competing currencies

- How to get out of this problem?

- The currency monopolies must be dismantled

- Russia and other countries must protect against the harmful effects of the monopoly currencies

- A criticism of austerity and criticism of austerity criticism

- West losing competitive advantage through platform inflation

- As long as the euro doesn’t budge, the people will cringe

- Problem is debt, not inflation

- The IMF agrees with our analysis but sticks to its guns

- But what for this perpetual growth?

- Lessons to learn from Japan

- Krugman steps in it

- The inevitable decline of the West – the currency monopolies being the last bastion of the West

The Fed and ECB have through abuse of the dollar’s and euro’s market dominance destroyed the market economy

The principal reason for the global financial turmoil is that the Western governments have destroyed the system of market economy after years of abusing their market dominance on the strength of the predatory monopolies they have cut out for the dollar and euro.

We can no longer by any stretch of theory call the US and European economic systems market economies. In their new incarnation, these economies more closely resemble a type of planned economy. Though, not like it was in the Soviet Union, where the central planners decreed the price of each and all goods and services, instead our modern day central planners – the central banks – strive to determine the price of the most important of all goods, that is, money, by artificially setting its price, the interest rate, by administrative decree, without regard to any market mechanisms. This way the central planners aim at controlling indirectly the prices of all other goods by determining the general price level through inflation targeting.

The market abuse has continued with increasing ferocity ever since the dollar central bank, the Federal Reserve System (Fed), launched its low interest rate policy to support the markets in the wake of the burst of the dot-com bubble in 2001. From then on, the Fed has acted like a drunkard trying to cure the ever new hangover following one failed policy after another with more of the same in a debt binge that has by now lasted fifteen years. After the subprime mortgage crisis in 2008, the Fed let all hell loose flooding the market with fiat money as if taking “just one more” quick fix out of the quantitative easing bottle. By now the Fed has together with its drinking mate, the European Central Bank (ECB), effectively attached the Western economies to an IV drip continuously feeding zero-rate money into the patient that used to be called the market.

The zero-rate market abuse is a pyramid scheme about to bust

The problem is that the central banks have not limited themselves to their legitimate role of regulating interest rates by means of central bank financing, but also ventured to directly intervene in the markets with generous interjections of gratuitous money by way of acquiring through illegal schemes bonds of practically bankrupt governments and pumping money directly or through a few privileged banks into the stock and bond markets. By these actions they have created previously unimaginable simultaneous stock and bond bubbles, both markets now being at all-time highs. According to market theory, stock and bond prices should move in different directions, bond markets increasing in value when investors are bearish and seek safety, and stock markets rising when they are bullish, but this should not possibly be true for both simultaneously. Just one of the many signs of how the real markets have been destroyed. Another sign is the curious correlation of all Western stock and bond markets moving in perfect lockstep across the globe hour by hour without any regard to the unique economic fundamentals of one or another traded entity. As one observer put it: “It’s impossible for our markets to move like one, gigantic, synchronized yo-yo, every minute of every hour of every day. Markets diverge, it’s what they do. When we see prices move together in near-perfect clockwork, we know we no longer have markets.”

By now, it is however finally dawning on even the most diehard monetarists that the Bacchanalia has reached its climax and the end is nigh. The manipulated debt-driven casino economy cannot go on for much longer as it is building up to a total disaster. All central planning schemes, pyramid schemes and persistent market manipulations will sooner or later end one way or another, whether thwarted by law enforcement or bumping against the hard reality of the real market, which is always lurking in the shadows even when the center stage is temporarily occupied by a market anomaly. Incidentally, we are witnessing the last days of this enormous rigged Western casino. The zero-rate market abuse is nothing but a pyramid scheme, which has now reached all the way to the top of its all-seeing eye just moments before it is about to be impaled.

The pyramid scheme has now reached up to the all-seeing eye, which is about to be impaled any moment now.

All economic and political monopolies will vanish sooner or later

As a monopoly first emerges, it might seem a boon to everybody affected, but by time market imbalances and disruptions in the orderly functioning of the market accumulate. By time, competitors and suppliers begin to suffer, then the consumers are hurt and cracks appear at the monopolist’s itself. Eventually the monopoly is thrown into an existential crisis until it ultimately disappears.

In an economic analysis, we should forget about the ideology and try to grasp that in economic terms the Soviet economy was a monopolistic system brought to the extremes. The problem was not state ownership as such, but the fact that all ownership was concentrated into the possession of one capitalist, that is, the state under the centralized management of the Gosplan, the state planning agency. The reason the Soviet economy died away was that the entire system lacked the vitality normally brought about by competition because of its rigid monopolistic structures that ate away at the economy from within. There is a belief that a monopoly by definition could behave independently of competitive pressures, but this does not acknowledge the fact that the enterprise that is the monopoly would require competition for its own survival.

With perpetual zero-rates, the Western central banks have lost their capacity to regulate market through interest

The Fed and the ECB, have actually already lost their capacity to determine the interest rates, for they are by now incapable of raising them any further; the interest rates will lie dead for ever after on the bottom of the leaking pile where the once omnipotent central banks pushed them – that is, until the system bursts and is replaced by a new economy. All that’s left for them to do is by their last efforts to keep the zero-rates in a desperate effort to delay the final day of reckoning. Any attempt to lift the rates – or mere talk about the possibility – will cause the markets to go bonkers, as evidenced by the recent global market turmoil.

The Western system is now so completely defunct that it can maintain a superficial glow of prosperity merely by the central banks fueling them with the zero-rate financing. Even a mere one-percent interest rate hike is more than these derailed markets can stomach. Analysts agree that actually raising the interest rates and ending the supply of free credit would set US markets for a free fall. Therefore the Fed does not have any other choice than to continue its disastrous policy of propping up the rigged stock and bond markets with its zero interest-rate policy and move on to QE4, QE5, QE6 and so on until the whole system finally explodes.

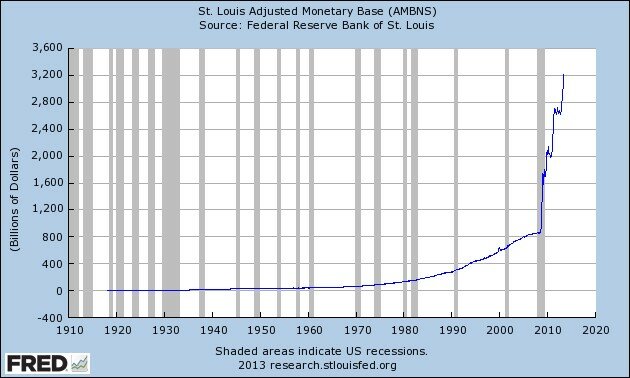

The Fed has pumped into the markets more than 3.5 trillion dollars through its bond-buying quantitative easing program since it was first launched in November 2008. This has pushed the size of the Federal Reserve’s balance sheet from less than 1 trillion in 2007 to 4.5 tn by end of 2014. This way the US monetary base has quadrupled over a period of less than 7 years (Exhibit 1) and as a consequence, there are now in this short time five times as many dollars to inflate the stock market bubbles.

Exhibit 1

An identical trend has been recorded in the UK where the FTSE 100 stood at 3542 points when the QE was launched in the UK, 9 March 2009, having reached 7103 points on 27 April, 2015.

But the money flowing into the markets in form of the QE operations have not trickled down to the real economy (as the government tries to convince us), instead it has mostly fueled stock market speculation with the stock indices breaking record after record. The beneficiaries of this morbid system are but a chosen few Wall Street and Citi bankers who receive the free funds from the central banks to rig the markets and executives of stock exchange listed companies who use such gratuitous money to buy back the share of their own companies at spectacular personal gains while pushing the stock prices higher. This monopolistic abuse comes with corruption and market abuse in all shapes and sizes as outlined in this article. As a result, the Western stock markets of today are best compared with rigged casinos where the shares do not have a real market based value and the quotes only reflect how much they have benefitted from central bank munificence.

Massive new debt hides years of negative GDP growth in EU and USA

In the beginning, the euro was all triumph and euphoria, the Eurocrats and their media spread the joyous gospel of permanent low interest rates and stability. But soon, the effects of the market distortions started to pile up with an ever-increasing pace. Given the now defunct Western centrally planned markets, there has been no market mechanisms, no invisible hand, to restrain the debt binge as the Western governments have substituted real economic growth with a debt-fueled façade of prosperity. As growth in the European Union remained sluggish, the governments encouraged corporations and citizen to load themselves with debt. In the aftermath of the global financial crisis in 2008 – which in itself was caused by excess debt – the governments in order to ensure their reelection with the cunning help of the ECB set to cure the devastation by taking yet more debt. The Eurozone countries blew up the public debt bubble by 2.8 trillion more euro in just six years, up from a debt-to-GDP level of 66.2% to 90.9% in 2014, and expected to reach 92% this year. In the same period from 2008 to 2014 the GDP of the Eurozone increased only by less than half a trillion. Once more…with 2.8 trillion of new debt they managed a growth of only 0.5 trillion. And that calculated in current market prices not considering the inflation. In effect this means that the combined loss in GDP for the period was 2.3 tn (financed by new debt).

Interestingly the growth of all EU countries combined, including Eurozone and non-Eurozone countries was in the specified period 1.675 tn euro, deducting from this the Eurozone growth of 0.476 tn euro we see that the combined growth of the non-Eurozone countries was twice as much as that of the Eurozone. Hereby good to bear in mind that the combined economic size of the non-euro countries is only 1/4th of that of the Eurozone. It has then clearly been a successful policy to stay out of the euro.

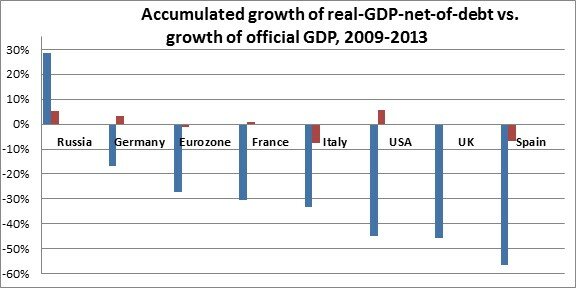

In a groundbreaking study Awara Accounting revealed that the real GDP growth of Western countries has been in negative territory for years, ever since the financial crisis of 2008. In fact, all the economic growth that has been recorded in the West since 2000 must be uniquely attributed to debt-leverage on all levels of economic actors, as also shown by a report by McKinsey, which is discussed below. Only by massively loading up debt have these countries been able to hide the true picture of their encumbered economies and delay the onset of their inevitable collapse. The study shows that the real GDP of those countries hides hefty losses after netting the debt figures, which gives the Real-GDP-net-of-debt. There has been no real growth in the West since 2000 and there will be none, perhaps never again, at least until the present system is wiped out and a new economic order emerges.

The shocking figures from the Awara study depicting the virtual crippling of the Western economies from 2009 to 2013 are illustrated in Exhibit 2. It shows the real GDP growth net-of-debt after deducting the growth of public debt from the GDP figure. Net of debt we see the scale of destruction of the Spanish economy, which amounts to the staggering figure of minus 56.3%. This while the conventional official method of crediting GDP growth with growth of debt would give only minus 6.7%. The corresponding figures for the Eurozone in total are -27.2% for the debt adjusted GDP and -0.2% according to the official method. Even Germany’s true economic health comes out surprisingly dire in this analysis, with a GDP growth net-of-debt of -16.6% versus an official GDP growth of -0.7%. The figures of those debt-ridden Western countries are compared with that of the financially prudent Russia. It is shown that in the same period Russia has been able to generate real GDP growth net-of-debt of 28.5% with an official GDP growth figure of 5.7%.

Exhibit 2

Central bank orchestrated debt binge – Global debt up from $87 trillion to $199 trillion between 2000 and 2014 (Q2)

The ECB orchestrated the debt binge by its policies and virtual zero-rate gratuitous financing. The ECB had made a point of propagating the belief that all Eurozone countries were equal risk thus encouraging banks to lend to practically insolvent countries like Greece without discrimination. In the collective euro-monopoly this belief was widely shared by all major market players. Even the cartel of the three leading Western credit rating agencies, Moody’s, Fitch and Standard and Poor’s, fully adapted to the role of cheerleaders in the Euro debt rally. They awarded all Eurozone countries wonderful ratings, Greece being no exception. The mere fact of having adopted the euro as the national currency meant for them that the credit risk was waved once and for all. (”We never thought of such a catastrophic stress scenario in the euro zone,” said Sara Bertin, who was Moody’s lead analyst on Greece before leaving in spring 2008”).

The Euro has destroyed the economy of Greece.

It’s a no-brainer that on a normal market the less-solvent a debtor, the higher the rate of interest the debtor is charged, but today when the Western nations are less-solvent than ever (practically bankrupt, keeping afloat only with the desperate central bank financing) they pay lower interest rates than ever before in the history of mankind. As a matter of fact, today 25 percent of all government bonds in Europe actually have a negative rate of return. If the interest rates were ever to be returned to normal market conditions these governments would immediately implode under the weight of their debt. A relatively low level of 3 to 5 percent interest would already sink them.

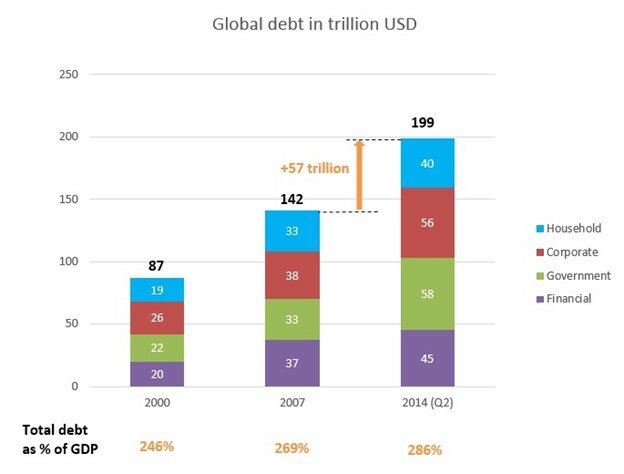

A study by McKinsey shows that the debt on all levels of economic actors: government, corporate, households, and financial institutions have grown astronomically from 2000 to 2014. As we pointed out, it is only by virtue of this debt that the Western economies have been able to show any growth at all, and even so a very misery growth. The McKinsey report shows (Exhibit 3) that global debt had risen between 2000 and end of 2007 by $55 trillion from $87 trillion to $142 trillion, and since the 2008 bout of the perpetual crisis by a further $57 trillion to $199 trillion (2Q 2014). Just imagine that it took mankind the first 2000 or so years to build up $87 trillion of debt and then just like that in a couple of years it was more than doubled. Smell a rat?

Exhibit 3

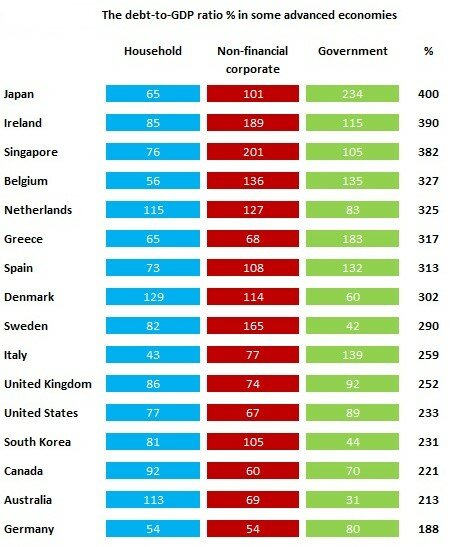

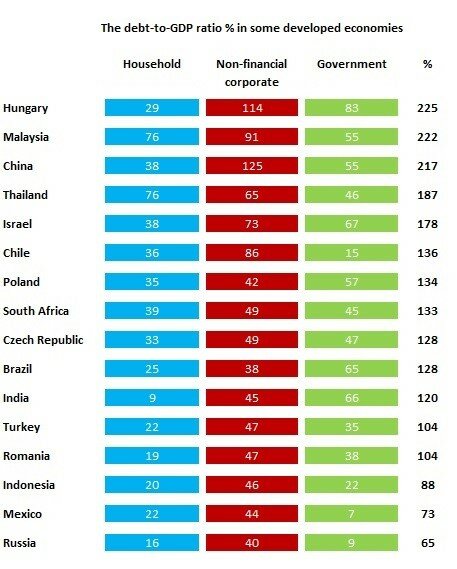

The McKinsey report corroborates the above-referred Awara study inasmuch as it shows the huge debt-to-GDP ratios that the Western economies have run up. This is evidenced by Exhibit 4A. Those are compared with some of the developing countries in Exhibit 4B. Remarkably it is Russia that has run the most prudent and healthy policies having with 65% the lowest debt-to-GDP ratio of all advanced and developed countries.

Exhibit 4A

Exhibit 4B

Western countries now practically centrally planned economies

These central bankers get away with the market manipulations not because they are so smart, but because they abuse their dominant positions on the market owing to the monopoly of the US dollar and euro. The legislators in all developed countries have acknowledged the hazard that a monopoly presents to the functioning of a market and the well-being of the population and they all apply (at least in principle) anti-trust legislation to break up the monopolies in order to restore the viability of the market. And yet, these currency monopolies are the biggest monopolies of them all being directly responsible for the destruction of the fundamental mechanisms of the whole market economy.

In a real market economy, it would never have been possible to press by fiat the interest rates down to zero, and even the negative as it has been done in the glorious EU. These are powers that central bankers do not possess in normal market economies as we used to experience them; not to mention how it is supposed to be according to the hallowed theory of the perfect market. In a well-functioning market economy, the exchange value of the currency goes down when interests decline and vice versa. According to the theory we were brought up with – as corroborated by the empirical observations of our youth – zero interests would again push inflation up. But, the FED and ECB have routed the market keeping near zeros on all three counts: interest, exchange value, and inflation. The dollar and the euro have kept their values against all the other currencies in the world with the ridiculous interests and the inflation in their pockets. From time to time, the dollar and euro ascend and descend against each other without any apparent reason in a movement resembling two kids bouncing back and forth on a seesaw, but in relation to all other currencies, they stay their ground.

These market distortions have brought in their wake negative real interest rates, meaning that the nominal interest charged is less than the inflation rate. What this essentially means is that savings are being eroded and waste is encouraged as you cannot earn a real yield without considerable speculative risk taking, bankrolled by the Fed. On these centrally planned money markets normal risk taking is not really an option, because with the negative interest rates and administrative allocations of the free funds the mechanisms for determining market based risk premiums are dead. In a market economy, a risk premium is the actual excess of the expected return on a risky asset over the known return on the risk-free asset. But with the Fed and ECB driving up stock prices and other choice assets (such as environmentally hazardous shale-oil) or stimulating car producers, or one or another sort of supposed environmental friendly technology, or anything at their whim and based on the latest political caprice, you don’t have any basis as an independent investor to do your own risk calculations. Only the privileged few can do their risk-reward calculation. Their safe bet is the stock market, can’t go wrong, if the market crash the Fed will inevitably bail them out – until the last crash.

In essence the new planned money markets have created an economy that rewards short term speculation spelling inefficiency in the allocation of resources and labor.

Currency colonialism is not good for anybody, not even USA and EU proper

A real market economy is a system of competition, where the coincidence of various competing forces -as if led by an invisible hand, as Adam Smith put it – bring about prosperity. This requires competition on absolutely all levels of the operations of the market. Indeed, the competition should start at the level of nations. The geopolitical situation in the world should be such that all nations could on equal and fair conditions participate in peaceful competition. This condition has obviously not been upheld during the last two centuries of Western hegemony and the increasing unipolar world led by the USA.

At the next level, competition has to be guaranteed at the level of currencies; the global financial system should be such that there are competing currencies, instead of the present monopoly dominance of the US dollar and the euro.

With increasing financial problems and economic problems in the USA and EU countries, we should understand that this currency colonialism in form of the currency monopolies is detrimental even to these countries themselves. The proper functioning of their own economies would have required competing currencies. It is as Friedrich Hayek said: “The past instability of the market economy is the consequence of the exclusion of the most important regulator of the market mechanism, money, from itself being regulated by the market process” (in Hayek: Denationalisation of Money – the Argument Refined).

Western economies of today are not liberal free markets; “neoliberal” = “neo-Bolshevik”

The monopolization of the global financial system by the US dollar and euro in fact means regulation of massive proportions as the US and European central banks have converted themselves into global central planning agencies. The harmful regulations conducted by these anti-free market institutions must be dismantled. In a weird twist of logic, many – especially those with leftist sympathies – criticize the Western financial system for supposedly being based on a neoliberal free market ideology. Well, maybe it is “neoliberal” but it is not liberal and not free market, that’s for sure. It seems to me that in essence this neoliberal ideology is an Orwellian concept aimed at naming a system by the opposite of what it in essence is. – In fact, the same goes for the broader term of “liberal” which nowadays is self-assigned to people propagating systems and ideas opposed to freedom in all aspects of life, political, social, and media. I would rather term those people neo-Bolshevik.

Ditching market economy in favor of central planning led to market abuse and corruption

It is the Western central bank regulations and other means of central planning of the economy and life by the Western governments that have led to unfair practices and outright corruption which favors a few well-connected banks, corporations and individuals. There is wide and motivated outrage for how the Western central banks have been aiding banks and publicly listed corporations leading to spectacular unearned personal gains by the bankers and executives in form of bonuses, stock options and capital gains through central bank financed stock buybacks. This is true, but people should realize that this is not the free market system; these are symptoms of a corrupt centrally planned system with monopoly currencies. In a real free market, no central bank would possess the capability of rigging the interest rates, debt levels and stock markets the way it now happens in the centrally planned Western economies.

A real market economy is a homeostatic self-organizing system

A real market economy is a homeostatic self-organizing system with a continuous movement for adjustment towards a new equilibrium. In such a system, interest, currency value, and inflation should move in a harmonic relation to each other as if guided by an invisible hand. Nobody would be at will to rig one of the components without facing a backlash on the other two. Had there been a functioning market, the Western governments would never have been able to rack up all the exorbitant amounts of debt that they now have. With increasing levels of debt, the value of the currency would have fallen, and inflation and interest rate would have gone up. As this is in a healthy market economy an automatic process, we would never have entered a global crisis if the market economy had stayed alive. From time to time, one or another country would have managed to get itself in an untenable debt situation, which would only have served as a signal for others to be more prudent.

Drachma would have protected Greece against the catastrophe

Take the case of Greece. If Greece had retained its own currency the drachma, then she would never have gone into the present catastrophe, the market would have automatically sorted out the imbalances. Investors and analysts would have kept a watch on the country’s debt levels and with raising borrowing the interest rates in drachma would have risen and the currency’s value had dropped with the result that there would have been less borrowing and the public finances and national economy would have retained their balance. But, having joined the monopoly currency, everybody became numb to interest and exchange rate sensitivities of the Greek market, it was as if all market mechanisms would simply have been cut off. The ECB exacerbated the situation from the very beginning by offering generous central bank financing to the Greek banks, on equal lenient terms as to all other Eurozone banks, thus acting as a Pied Piper showing the way to ruin to the private banks and investors. In particular, the ECB in an act of stunning foolishness accepted the Greek government bonds at face value as collateral for central bank financing without any regard to the financial standing and creditworthiness of Greece.

The rise of the US dollar hegemony

The USA has enjoyed its dollar monopoly firmly for decades since the end of World War II in 1945, whereas the Europeans have been at it with the euro only since 1999. The dollar acquired an absolute monopoly on a global scale, whereas the euro became a regional monopoly in Europe with effects detrimental to the global economy.

The dollar hegemony, as the monopoly is sometimes referred to, was solidified in the mechanism awarding the USD the status of a so-called reserve currency. By a reserve currency it is meant that other countries hoard that currency in an effort to stabilize their own currencies, thus effectively extending gratuitous financing to the United States.

The US dollar reserve currency status did not happen through the emergence of market forces, rather it originated in a geopolitical coup, and it is upheld to this day by geopolitical power. The coup in case was the allied victory in WWII after which the victorious powers, except the USSR, concluded a treaty at the Bretton Woods Conference of unconditional surrender of global currency rights in favor of the dollar, effectively handing the global currency monopoly to the USA.

The idea of the Bretton Woods was that the US dollar (and through it, all the other currencies) was to be tied to the gold standard ensuring convertibility of the dollar towards gold. But as the USA was persistently oversupplying the global markets with the dollar it could eventually not anymore uphold the gold peg eventually forcing US president Richard Nixon in 1971 to take the dollar off the gold standard. This effectively ended the Bretton Woods System, which then was replaced by a regime based on freely floating currencies. In the new system, the dollar not only retained but strengthened its hegemony, its global currency monopoly. Ever since the Bretton Woods treaty the dollar’s dominance has been supported by the US controlled edifice of the global financial architecture, the International Monetary Fund (IMF) and the World Bank, in which institutions it retains a veto power over major decisions.

Unfair benefits through monopoly abuse

The privilege of possessing the global dollar monopoly has conferred on the USA a number of unfair advantages. The USA has been able to run current account deficits year after year, which have been financed by printing new dollars. Essentially this means that real physical goods produced in other countries have been exchanged for the paper on which the dollar is printed (or later the electronic data that represents dollar accounts). Trading with their foreign counterparts in their own national currency, US companies were freed from currency exchange risk, which others suffer from. This increased the economic predictability in their financial planning and lowered transactions costs relative to business of other countries. A feature of the dollar hegemony has been that the prices on nearly all of the world’s essential commodities – oil, gold, metals, cereals and other commodities – are quoted and settled in US dollars. This has acted like an automaton ensuring constant demand for dollars. As a consequence, of the dollar hegemony, much of the international trade is invoiced in U.S. dollars even bilaterally between countries and in regards to goods not involving the United States. For example, according to a report 86% of all foreign exchange transactions around the world in April 2007 were against the US dollar. The same report identified that in August 2009 that 77% of the global outstanding stock of investment grade bonds were denominated in the two monopoly currencies, dollar and euro, while the Japanese yen and the British pound gobbled up a remaining 20%, leaving merely 3% to all the other currencies of the world.

The monopoly status as the leading reserve currency has forced other countries to hoard dollars and dollar assets as reserves, thus financing the US deficits. In the dollar world, countries must do so in order to have at all times a sufficient amount of dollars to pay for the foreign trade transactions denominated in dollars and to service dollar-denominated foreign debts. Another reason for countries to accumulate dollar reserves is to sustain the exchange value of their domestic currencies in order to prevent speculative and manipulative attacks on them. To make things worse, the higher the market pressure to devalue a particular currency, the more dollar reserves the central bank must hold. However, the USA itself does not have to keep any reserves of currencies of other countries, not even gold anymore, which it still did prior to the 1971 free float of the dollar.

All this means that the US government and corporations can borrow at lower costs than those of other countries (or no cost, as it is now). Some of the funding comes literally for free by way of foreign central banks, and businesses and households of other countries stocking on dollar bills. The reserve currency scam has actually become a veritable rip-off of the developing world. The developing countries have been forced to hoard most of the reserve currencies holding 2/3 of the whole global stock of the reserve currencies (2009) at the same time as the share of the advanced economies has dropped to 1/3.

This has resulted in a veritable capital deprivation of the developing countries, which have according to IMF data been compelled to hold reserves to an equivalent of 21.9% of their GDP (2008), the corresponding figure for the advanced economies being 5.5% (2008).

In addition to the economic gains and power through the financial hegemony, the dollar monopoly has also directly enhanced US military power as it enables the financing of the heavy military build-up, overseas bases and military operations with simply printing more dollars out of thin air.

One more way of abusing the dollar monopoly has been the habit of the United States to impose unilateral sanctions against other governments, businesses and individuals in an attempt to enforce the adherence to US laws and national policy interests.

Western central banks acting in collusion

As a consequence of the dual global monopoly of the dollar and the euro, the other Western currencies, British pound, Swiss francs, Swedish and Danish crowns etc., have benefitted (as far as we can looking at the present day devastation call these effects benefits) from the side effects of the monopoly as the euro indicators became the new normal. They could essentially slipstream after the euro; all they needed to do was maintain marginally better indicators. Even the spectacularly indebted Japan has been kept afloat thanks to these spillover effects. No doubt, the Western central banks have been coordinating their actions on supporting the currencies in their pool. It has now emerged that they have even engaged in joint operations to inflate the asset prices on the stock market as Paul Craig Roberts writes. Mr. Roberts reported that the Swiss National Bank, the central bank of Switzerland, has without any apparent reason been buying vast quantities of US shares. He brings attention to the close relation between the Swiss holdings of US stock and the rise of the US stock markets as evidenced by the S&P 500 index. The conclusion he invites us to draw is that the Western central banks have now (illegally) extended their scope of activities beyond their chartered functions (of controlling inflation) to encompass that of inflating asset values by pumping up the stock markets. The Fed, as also the ECB, is legally prohibited from purchasing shares but by way of manipulating legal loopholes, they now lend money to banks that use the funds to buy stocks, essentially on behalf of the central banks and on their gratuitous financing. Mr. Roberts surmises that the Swiss central bank could be operating in this scheme as a covert agent of the Federal Reserve.

The ECB and its subsidiary European national central banks are equally forbidden to acquire government bonds, but in patent breach of this stipulation, they circumvent the restriction by using commercial banks as middlemen. The central banks instruct the commercial banks to acquire the government bonds, which they then resell to the central banks in schemes agreed in advance. This is just one of the various ways that the central banks manipulate the markets on the strength of their currency monopolies with the intention to maintain super-low interest rates and to keep the debt rolling in.

Friedrich Hayek and competing currencies

It is not as if we were not warned about the dangers of monopoly currencies. The Austrian economist and Nobel laureate Friedrich Hayek was a vociferous opponent of currency monopolies. In particular, he was adamantly opposed to the creation of a European single currency, which was already being plotted in the late 1970s. (Ideas on that account going back even further). Opposing central planning, Hayek argued that to ensure financial stability competing currencies were needed in place of the government monopoly to issue money. Hayek had strong words of warning for the Euro saying he had “grave doubts about…creating a new European currency managed by any sort of supra-national authority” (in Hayek: Denationalisation of Money – the Argument Refined). He condemned the “Utopian scheme of introducing a new European currency, which would ultimately only have the effect of more deeply entrenching the source and root of all monetary evil, the government monopoly on the issue and control of money”. Time has proved Hayek right.

The Euro-elite should have listened to Hayek.

The central tenant in Hayek’s monetary thinking was the idea of competition between currencies. Hayek, however, went as far as to argue that the governments should relinquish altogether their powers to issue money in favor of private sector issuers. He advocated the idea of creating a monetary system with an unlimited number of private banks which would function as the issuers of currency. The currency values, interest rates and by implication inflation levels, would be established by the forces of competition on open markets. Hayek had in mind an idealized perfect market scenario. But markets can never be perfect because they are always subject to distortions due to various natural and socio-political causes such as power-politics, geopolitics, wars, collusions and other conspiracies, supply shocks, natural disasters etc. For all these and other reasons, the financial markets cannot possibly function in the required theoretical perfect market conditions. It therefore seems to me, that it is better to retain the power to issue money with governments. It could make sense to also allow supranational bodies to issue a currency as long as that would not lead to the kind of monopoly abuse as we have in the case of the euro. In this connection, let me float the idea to explore the possibility to issue some sort of special asset-backed currencies either by private enterprises, governments or intergovernmental entities. For example, Russia could consider issuing a gold backed currency, in addition to maintaining the ruble as the main national currency.

While rejecting the idea of denationalization of currency with a total transfer from government to private issuers, we should, however, not relinquish the main idea behind Hayek’s thinking, that of the need to ensure competition between currencies. We would need to achieve a situation were no currencies can exert a monopoly influence on the global markets as it is the case today with the US dollar and the euro.

A well-known euro apologist, the German Otmar Issing, has argued that the euro supposedly came close to meeting Hayek’s requirement of breaking the monopoly of national currencies.This was achieved, Issing claims, by doing away with all the independent European currencies and replacing them with the all-encompassing monopoly currency. Issing argues that the point is that the European Central Bank and the subsidiary national central banks are now ostensibly independent from the national governments and free from political interference. “The Maastricht Treaty says so”, Issing argues, and therein lies his proof. The more so, Issing rhapsodizes, “according to their respective statutes, the central banks cannot take instructions from these governments.” We are not impressed. The supposed independence of the European central banks as well as all other central banks in the world is nothing but a big bluff. What Issing should say is that they are independent of democratic control, that’s what they are. But that’s the one thing they should not be independent of. Instead of democratic control, they are totally under control of the small political, financial and intelligence elite that rules the Western world. The central bankers are even appointed from their ranks. Beyond any doubt the ruling elite in secrete conclave appoint and dismiss the central bankers at whim and exercise any amount of influence on the bankers as they seem fit. The central bankers are part of the same elite, working on their mandate and for their benefit.

The situation with the euro monopoly is the more dire, when we consider that at the same time the competition between banks – a condition Hayek employed for advocating his theory – has been severely constricted due to a significant reduction in the number of banks as ownership has concentrated, and due to the fact that the they are all dependent on the same centrally planned financing administered by the Fed and ECB.

As Hayek predicted, the creation of the Euro represented a most catastrophic turn for Europe and the global financial system in total.

How to get out of this problem?

So, how do we get out of this problem? No way, really. Except through the inevitable final crisis of catastrophic proportions looming ahead.

The problems induced by the dollar and euro monopolies have accumulated to such proportions that there is absolutely no cure within the existing system. The Western elite is absolutely not prepared to attempt the needed reforms, which would involve a break-up of the currency monopolies. Instead, they are hell-bent on prolonging the financial agony as long as they can keep borrowing and printing money. Therefore, we cannot count on any sort of soft landing, the system will eventually be annihilated in one big bang after years of a creeping decline during which they will be squeezing the old system dry to the last drop. Mark my words, eventually the monopoly currencies will lose their credibility and collapse causing a great depression with a wave of bankruptcies wiping-out asset values, causing unemployment and social upheaval of enormous proportions. Personally, I believe that this will happen within ten years, perhaps as soon as five, or who knows, maybe even any day now?

The Western economies will founder, question is how soon?

The currency monopolies must be dismantled

The global monopoly dominance of the dollar should be dismantled by way of breaking its hold on global markets in all the ways that enable the present abuse:

- Lessen the dollar’s role as reserve currency by promoting other currencies as reserve currencies; such should be the Chinese yuan, but also others on a broad range

- BRICS and other independent countries should on a voluntary basis use the currencies of each other as reserve currencies in their central bank holdings

- Promote the use of other currencies in international trade by quoting prices and settling transactions in competing currencies with an emphasis to use the currencies of the trading partners at least for settlements (while the price still could be quoted in a more prominent currency)

- Quote price of oil, gold and other commodities in other currencies except for the dollar. (Incidentally this is what China is doing right now)

- Break the stronghold of the dollar in international financial institutions such as the IMF and the World Bank. Countries should discontinue the practice of publishing the holding of international gold and currency reserves in terms of dollars

- Develop new globally democratic financial institutions as it is now done under the leadership of China and the other BRICS countries (The Asian Infrastructure Investment Bank, AIIB, and BRICS Bank)

Individual European countries would still stand a chance to rescue themselves from the impending catastrophe. Whereas it is a foregone conclusion that the euro monopoly will break (possibly with the disappearance of the whole currency), individual countries as yet have the window of opportunity to pull out from the collective suicide pack by ditching the Euro and returning the respective national currencies. The Euro exit would no doubt cause a momentary economic depression in the affected countries. Without pretending to any scientific accuracy, I would estimate that, for example, in the case of Finland, this would entail a 10 percent decrease in GDP in year one and a further 5 percent in year two, after which the economy would again grow. That would certainly be preferable to a total demolition of the economy the way it is now heading. The beauty of the timely euro exit is that you can cushion the effects when you go against the stream and take advantage of the other countries still trying to prop up the dying euro-beast.

There is all reason to be worried for the dollar.

Russia and other countries must protect against the harmful effects of the monopoly currencies

The implication of all of this for all the other countries of the world is that they must protect their markets against the monopoly abuse of the dollar and euro. As long as those currencies maintain their monopoly dominance, other countries should enact, where feasible, any anti-trust protection measures they deem appropriate. They must understand that with these dying behemoths roaming around the global currency market there is no real free market. They must therefore stop acting as if there were one and therefore they must stop being guided by the free market theory, as long as the free markets remain suspended as a consequence of the monopoly abuse. The theory is no good as long as there are no free global markets. With the strength of their monopolies, the governments and investors have access to a practically unlimited (for the time being until the coming final crash) gratuitous supply of dollars and euros which they part intentionally, part unintentionally use to distort the global markets. Any lesser currency that tries to play the market game is inevitably going to take a beating from the monopoly monsters time after time.

A case in point is the Russian ruble and the Russian markets. Again and again, Russia has been trounced on the currency markets with ensuing serious economic crisis caused by the foolish policy to pretend there is a global free market.

The gravest error Russia has committed is to benchmark its currency and its whole economy to the US dollar. During the past few years, Russia has taken the first timid initial steps to wean off the dollar, but these efforts should as a matter of urgency be ramped up. The Russian central bank has stopped hoarding dollars and the government has initiated arrangements to settle payments in its bilateral trade with other countries in the local currencies. Russia is also thankfully developing its own payment systems and exploring global alternatives to the SWIFT bank clearing system. Russia should not either shy away from implementing currency controls if needed, subsidies interest rates and do its own quantitative easing programs.

The dollarization of the Russian economy sits deep in the psyche of the country, to the extent that even the Russian president expresses the value of trade between Russia and China in terms of the US dollar. This is understandable in view of the history and the devaluation of the ruble, but nevertheless not acceptable. Better even to express that in terms of the Chinese yuan or even the euro. The idea of measuring everything in the dollar must be totally eradicated. This concerns also the Russian central bank, which expresses the value of its gold and foreign currency reserves in US dollars. Even the European Central Bank does not do so, expressing theirs in euro. As a matter of fact, the whole idea of regularly openly reporting about a country’s foreign currency reserves serves solely the purpose of propping up the dollar hegemony, the idea being to make all countries in the world compete in having as much dollars as possible.

There have been reports that Russia is planning to issue a common currency called the Altyn together with the Customs Union countries (Kazakhstan, Belarus, Armenia and Kyrgyzstan). This would on a normal market not be something I would be in favor of in view of my adherence to the principle of competing currencies, but giving the present defunct markets devastated by the dollar and euro abuse, this would admittedly seem to be the correct course to take. I think that it would also be worth exploring the possibility of issuing this common currency not instead but in parallel with the national currencies.

A criticism of austerity and criticism of austerity criticism

As a tactic to delay the final reckoning, the Western leaders have chosen to embark on austerity enacting spending cuts and increasing taxes in an effort to reduce government budget deficits. Or perhaps it is not a delaying tactic, for all I know they could actually believe in the viability of austerity policies. Whatever, but one thing is for sure: by austerity alone, no change for the better can possibly happen. What they need to do is to change the system. But they won’t.

On the other hand, the criticism of austerity policies is in most cases equally misguided as the policy itself. The mostly populist criticism appeals to emotions without offering anything in its stead and only foolishly insisting on more debt and money printing, as if that would be infinitely possible. I for my part insist that a criticism of austerity must be combined with a demand of ditching the euro monopoly and returning to the mechanism of a market economy with real interest rates and no bailouts of banks and failed corporations. In fact, all the talk of some austerity in the Eurozone is by itself an oxymoron. As long as the governments keep running huge budget deficits and taking more debt to finance it, you cannot logically call it austerity, stimulus is what it is.

I understand that one would like to criticize “austerity” because it is politically expedient, but I don’t understand how an educated person could possibly believe that the criticism is motivated. Believing that no spending cuts are necessary is tantamount to believing in perpetual pyramid schemes and the possibility that governments can go on borrowing infinitely at zero-rates, and believing in the infinite possibility to finance government spending and the whole economy with printing of fiat money. There is no way that this debt Bacchanalia can possibly continue for much longer. Most of the affected countries have reached their limits and are already lurching towards the edge of the precipice. It is entirely possible that any day now investor confidence in the euro would be eroded or that inflation would pick up for other reasons and then push interests sharply up. Already a mere 3-5% hike in interest rates would wreak havoc in the national economies and budgets of Eurozone countries.

If these people who criticize austerity believe so firmly that the euro is a horn of plenty offering limitless credit, then I wonder why while at it they don’t call straight away for doubling of the borrowing, or tripling, or why not take 10 times more debt? Wouldn’t it be fair according to their way of thinking that the government takes so much debt as to ensure a life of a millionaire to each citizen? Few would go as far as that in their demands, I assume – but cannot be sure – but then, where do they draw the line? Moreover, do they really think it is up to them to draw the line, and not the markets? – And why not extend the “fairness” to be global, why do these people not demand that the Western governments would borrow and print money for Africa, too? If there is this horn of plenty, as they seem to think, then why not share it fairly among all people in the world?

Seriously, the justified claim would be to attack the fairness (and economic sense) of the priorities of budget cuts and the politics behind these questions. Clearly, the treatment of the Greek people has not been fair. Clearly we must denounce the raping of Greece when it is obvious that what occurred is that the European elite and its central bank has nationalized the debt that Greece owed to the European banks, the same banks that caused the debt crisis in the first place (as engineered by the ECB). They effectively rescued, not Greece, but the European banks and transferred the debt to be shouldered by the Greek people and European citizens.

The correct way to handle the crisis would have been to let Greece default on the debt and the banks take the hit. If some of the banks had failed in the wake of this, then that would be perfectly acceptable in a market economy. Bankruptcies of failed business ventures form part of the discovery process of market equilibrium. In the ensuing situation, the aid from the European authorities should have been addressed to the Greek people by way of compensating their losses in the insolvent banks and by way of emergency crediting of businesses and the government until the situation would have stabilized. (This kind of financing distributed directly to the public and corporations is sometimes referred to as helicopter money). No doubt, this would have required a fraction of the funds that have actually been poured into the Greek crisis.

In the process, the Greek government should have defaulted on its euro debt and returned its national currency, the drachma. I consider that this is still the only viable option for Greece to ensure future prosperity of the nation.

West losing competitive advantage through platform inflation

The euro-monopoly and the persistent budget deficits that the Eurozone countries and the USA run serve to perpetuate the economic woes, and put off the hard decisions while building an ever greater bubble which will do the more damage when it bursts. By way of running these deficits, the West maintains – in fact, continually augments – its competitive disadvantage relative to the rest of the world. As a consequence, the cost of labor is pushed to an artificially high level, the dollar and euro remain overvalued, industrial production decreases and imports grow relative to exports. With the monopoly, there is no market mechanism to adjust the relative price level and therefore the imbalances and debt burden will keep growing while standards of living will keep shrinking.

The Western countries have for years experienced historically low levels of inflation. (At least according to the official statistics; there is, however, evidence that that the statistics are manipulated as to this effect and that the real inflation is indeed higher.) The inflation has been relatively low because on the strength of the overvalued monopoly currencies, the West has been able to maintain low and continually decreasing (in real terms) import prices from the rest of the world. At the same time the increasing unemployment and the need to redirect a greater proportion of income to service the exorbitant debt (coupled with the inability to borrow more) has reduced the domestic purchasing power of the people. This has further lessened the inflation dynamics and caused deflation to be the more pressing concern.

But while the nominal domestic inflation has been small (while not as small as officially claimed), there has occurred something which I would like to term platform inflation, by this I mean the general increase of the price level of one country relative to another. By the augmentation of the inflation platform, the cost of living and production have in the Eurozone countries become too high relative to the rest of world. This is something that has been realized and is discussed especially in Finland in reference to a need to undertake a so-called “internal devaluation”. The more adequate terminology, though, would be “internal deflation” since the aim is precisely to lower the costs of production input. The idea is, however, grossly misguided, as the policy aim (now official government program in Finland) is to undertake a deflation of production costs by reducing labor costs. In this way all this lofty talk boils down to very simplistic one-sided demands on workers to accept lower wages, longer working days, less holidays, and postponement of retirement. The problem is that such a policy cannot possibly cure the grave structural problems of the euro-economy, because the problem of the cost of labor cannot be dealt with in a vacuum apart from all the other cost structures.

The Finnish government does not realize that the price level in the country is not determined by wages alone. The cost of labor is actually a derivative of the EU system that works as a cost-automaton. In addition to the biggest culprit itself, the euro, the real problem in the Eurozone are the high taxes and the enormous share of public spending in the economy, as well as the bureaucratic system that stymies entrepreneurship. Following EU directives, the European governments have built a highly regulated market burdened by endless bureaucracy and rules that hamper competition and especially gravely hinder new enterprises from entering the market. If one in this kind of an environment only aims at cutting wages, then the result can only be an ever deteriorating economy, a veritable race to the bottom as the whole national economy spirals down after the lowered wages.

At best, such a policy could marginally improve the profitability of export industries, which minor benefits would be offset, by a drop in the purchasing power of the population, that is, by an immediate corresponding backlash in domestic consumption. This in turn would decrease the profitability of businesses serving the domestic market causing them to weaken and become unable to face the onslaught of imports, further reducing the Eurozone economy, and so on and so forth.

As long as the Euro doesn’t budge, the people will cringe

It is not imaginable that you fix these real problems by fleecing the workers, alas, this is the only policy the hapless European leaders have to offer. In one or another form, this drive to the bottom has been going on for at least eight years since the 2008 market crash. The only result has been the steepening death spiral.

Nevertheless, as long as the currency and the interest rates are in the Western systems removed beyond the reach of the market forces something else willy-nilly has got to adjust, and this adjustment will happen in the form of increasing unemployment and sinking standards of living through the effects of the platform inflation. As long as the euro doesn’t budge, the people will cringe. Indeed the real unemployment is growing at an alarming pace even considering that the governments are rigging the statistics by removing long-term unemployed from the numbers (that is, those that have not been looking for a job for a mere four weeks).

In addition to the workers, the savers are paying buy seeing their savings being eroded by the negative interest rates. The only winners in this system are the well-connected people close to the elite who receive the funds for market speculation and are regularly bailed-out

Summarizing my criticism of the misguided austerity polemic, I stress that a criticism of the need to enact severe budget cuts in the Eurozone countries (and the USA) is grossly misguided. There is no choice but to do it, if one proceeds from the premise to maintain the present economic system. The questions should be to discuss the priorities and mechanisms of the budget cuts, and especially how to fundamentally restructure the economy. Most importantly, though, it must be recognized that the whole austerity discussion, for or against, is grossly misguided. What people should discuss is how to get rid of the currency monopolies and to restore market economy. Opposing austerity without an advocacy of euro exit rings utterly hollow.

Problem is debt, not inflation

Inflation means a persistent rise in general price level. As measured by the consumer price index it has by historic comparison not risen a lot during the present continuous crisis. But, the crux of this issue is that it is precisely the consumer inflation that has not risen because the generous government financing does not go to the consumers, it does not even go to businesses so as to trickle down, as we are famously induced to think. Nay, it stays with the banks, which speculate with it in the casinos that used to be called stock markets. We do not habitually call the rise in stock prices inflation, but that’s what it is, an inflation of stock prices. In the period of quantitative easing the stock prices have doubled, or risen by 103% as measured by the Dow Jones Industrial Average (DIJA), which went from 8776 points at December 31, 2008 to 17,823 at December 31, 2014.

The consumer price inflation for the same period (as reported by US government) was in total only less than 12%. We see that the money supply that normally would have led to inflation has now instead been used to blow up an incredible stock market bubble. But there will be a limit for how much of the money can be absorbed by the stock markets and therefore the risk for rampant consumer inflation is high. Historically the stock markets trajectory has followed the inflation trajectory.

Economists habitually and wrongly explain inflation by the growth of money supply. This shows that the economists have a very limited understanding of the real world, and especially about elementary legal concepts. By this, I refer to the much-overlooked fact that the supply of money in itself can alter nothing, for the supply to have an effect some sort of a legal transaction must occur to the effect that the ownership of the newly supplied money be transferred from one party to another. This is not a mere semantic point, which becomes clear when we combine this first insight with a second one, namely that all financial crises result from excess debt – not from an excessive growth of just any money supply but that of debt.

The above discussion of the stock market inflation, that is the stock bubble, and the consumer price inflation illustrates the point that it is the legal transactions of money changing hands that cause inflation. Now, as there has been no mechanism – and no trickle-down – with which to transfer the money supply into the hands of the consumer, there has been no significant consumer inflation.

Economic crises in a market economies have always and everywhere been exclusively a phenomenon of excessive debt. (Perhaps with the exception of wars. – By market economy, I mean in this connection an economy which is not a total planned economy like the Soviet economy was. I needed to point out this, as I have stressed that as such we cannot anymore call the Western economies market economies for the reasons outlined in this article). It is excessive debt that causes all cyclical problems in a market economy, as businesses in a downturn will not be able to service their debts, which in turn is caused by the business opportunities being insufficient in relation to the excess debt, as the real economy cannot absorb the excess quantities of debt.

The downturn cycle will therefore be turned around only when the debt levels are adjusted to a sustainable level. Normally this would occur through divestments and bankruptcies. But the Western central banks and political elite have not been willing – or able – to understand this and therefore they have instead exacerbated the crisis with yet more debt. This will only ensure that a yet bigger catastrophe will hit those countries when the inevitable end game nears. Hereby they have engaged in the most perverse of all policies, which is to prop up the financial intermediaries, banks, which have caused the problems in the first place, instead of directing the aid to the corporations and households. (Helicopter money). The crisis could have been averted long ago with much lower costs if the leaders had let the market take its course, let the banks fail, and had they instead directed financial subsidies to the corporations and households. Such financial aid could have been allocated on gratuitous terms. Thus, there would have been an increase in money supply, without an increase of debt. In all essence the interest-free financing given to banks is also gratuitous, it is only by way of an accounting convention that it is referred to as debt.

We may cite Ron Paul in this connection: “Inevitably, the bubble bursts, the market crashes, and the economy sinks into a recession. – Instead of trying to “fix” the Federal Reserve, Congress should start restoring a free-market monetary system. – When bubbles burst and recessions hit, Congress and the Federal Reserve should refrain from trying to “stimulate” the economy via increased spending, corporate bailouts, and inflation. The only way the economy will ever fully recover is if Congress and the Fed allow the recession to run its course. – Increased spending and money creation may temporally boost the economy, but eventually they will lead to a collapse in the dollar’s value and an economic crisis more severe than the Great Depression.”

Hence, we should not really worry about money supply causing inflation, but about the kind of money supply that increases debt. Most of all we should worry about the excess government borrowing, money printing, and the financial bubbles it has created. I would add that we should not be overly worried about inflation either. In a market economy, inflation is also an important regulator. Suppressing it artificially, as the Fed and ECB have done, has clearly been proven wrong and it has had devastating effects on employment and savings.

These central banks have not understood that a correct reading of the money-supply-inflation theory in fact would mean that it is the debt levels that one intends to control and not inflation as such. They are therefore engaged in a highly perverse policy of pushing debt while restricting inflation. These objectives should precisely be reversed. The problem is not of stability of prices (inflation) but stability of debt. – To my mind, this understanding of the need to reverse the debt-versus-inflation policy corresponds to a proper understanding of Ludwig von Mises’s theory on inflation that says that inflation should refer to an increase in the quantity of money that is not offset by a corresponding increase in the need for money, to wit, which does not correspond to real economic expansion.

The IMF agrees with our analysis but sticks to its guns

The International Monetary Fund essentially agrees with our contention that there is for the West no way out of the financial despair caused by the dollar and euro monopolies (note: naturally, though, they have not defined the problem in terms of monopoly). In a speech in April, the IMF chief Ms. Lagarde, admitted that the IMF is well aware of the problems in the global financial system. She told that exceptionally low interest rates risks fueling asset bubbles around the world. In particular, Lagarde pointed out that life insurers and benefit pension funds could soon face solvency challenges.

But, not one for half measures, the remedy Lagarde offers is the unsurprising panacea of the Western elite: more debt. New debt will cure the West from the financial woes caused by the old debt, Lagarde reckons. She calls on the Western governments to pull out all the stops in order to fuel the markets with more of the “easy-money”. Quoting from a press report: “But the threat of prolonged low growth overshadows those risks for the IMF. Lagarde says the European Central Bank and Bank of Japan should continue their easy-money policies. // Countries with room to spare in their budgets [comment: there are no such Western countries] and that don’t have major debt overhangs should spend more to boost demand in the near-term, including on infrastructure, she said.”

Voilà! That’s the way to do it. Boys, keep printing that money, says Madame Lagarde.

Lagarde reminds us of a maniac spurring the lemmings on to towards the precipice and a certain suicidal death.

The Bank for International Settlements (BIS) echoed the dire sentiments voiced by the IMF in its annual report where it pointed out that the Western monetary policymakers have utterly failed in their policy of fueling the markets with zero-interest debt (without going as far as Lagarde to urge it cured with more of the same). The BIS asserts that the central banks are devoid of any further policy options after having repeatedly over the years been cutting interest rates to shore up their economies. The BIS argues that the low interest rates have fueled economic booms encouraging excessive risk taking. As booms have turned to busts, the policymakers have responded with even lower rates. Now as they are already at zero-interest this policy has run its course and there is no way to respond to the next bout of the now perpetual financial crisis.

But what for this perpetual growth?

On another note, I would like to know why Ms. Lagarde and her peers are so fixated with growth. What is this growth that must be achieved literally at any cost? I gather that it would be much wiser to concentrate the Western financial policy on the objective of quality. Maybe it would be about time to rethink this system of debt-leveraged capitalism, which is based on the inherent principle of perpetual growth in order to yield a positive return by which to pay off the debt. It would be better to transfer the emphasis on economic policy that increases quality of life and not gun for more and more growth fueled by the debt-bubble, the kind Ms. Lagarde is calling for. The ultimate object of that policy– in addition to complying with the precept of necessary growth according to the neoliberal religion – is to bail out the present financial elite and keep the sheeple content with the view on the next election.

The only correct policy that the present situation warrants would be to engage in serious restructuring of the debt burden and the global financial system, including breaking up of the currency monopolies. There would be casualties of course, many of the privileged banks would go bankrupt, large corporations would disappear, divest and change hands. No doubt, there would be a temporary surge in unemployment and financial distress among the population coupled with a permanent decline in the general standard of living in the West. But, there is no avoiding a fair adjustment in global living standards anyway, inevitably the standard of living in the rest of the world will grow vis-à-vis the West. Unfortunately this will in addition to real growth in the Rest be coupled with decline in the West. It is vastly more preferable for this to happen in an orderly fashion as long as it could – perhaps- still be done, than by going for the financial and economic Armageddon, where we are presently being driven to.

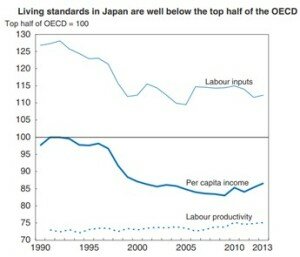

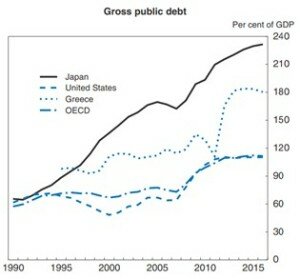

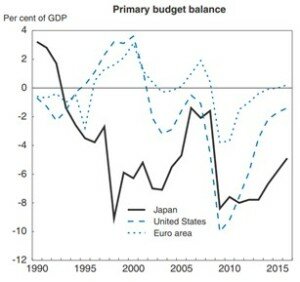

Lessons to learn from Japan

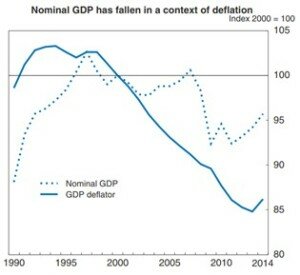

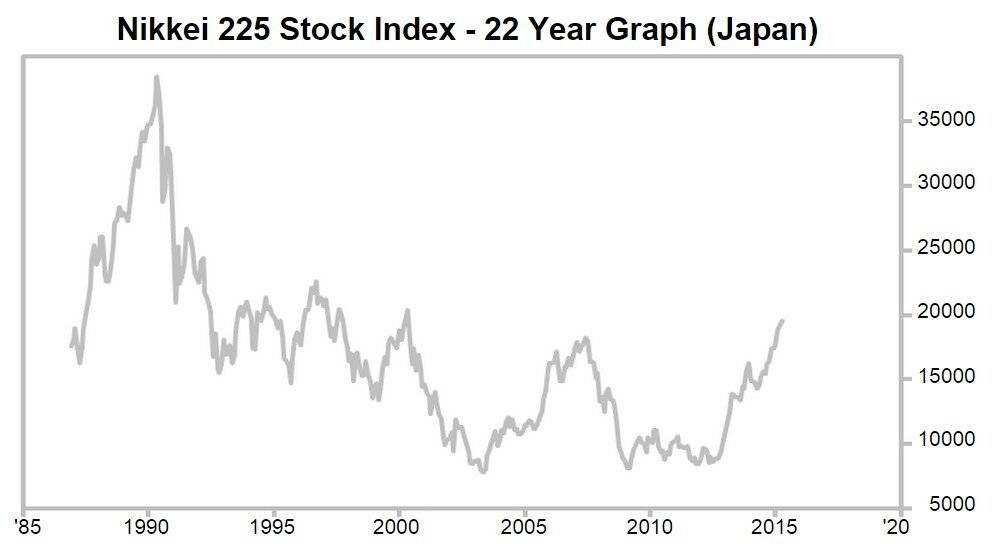

The dismal economic development of Japan after 1990 serves like a case study to illustrate the theses of the present study. Following a collapse of the Japanese asset price bubble in 1990, Japan entered a severe crisis. This was followed by a prolonged recession – actually one that has continued ever after to this day – which subsequent Japanese governments have attempted to cure by excessive and wasteful government spending and easy-credit. The public spending spiraled annually to around 43% of GDP and government deficits soared to as much as 8% of GDP, and public debt started to rise, so as to reach the present more than 240% of GDP. Notwithstanding a decade of this wasteful spending, Japan did not manage any economic recovery and continued to be plagued by persistent deflation. Then when nothing seemed to help and Japan had run out of policy options, the government introduced in 2001 the first modern-day “quantitative easing” program with the aim of kick starting growth and provoking inflation. However, the QE programs that Japan has run, with increasing ferocity in the last few years, have failed to fix the economy.

During the years of adhering to these policies ever since 1990, Japan has regressed on all major macroeconomic indicators, but we can also point to one major success: Japan has been able to stave off the ultimate market based restructuring of its economy, which event the country has exchanged against a slow and agonizing slide down the tube. It is this feast that the other Western countries now strive to emulate. But the problem is that Japan has been able to sustain that policy for so long because it has the dubious honor of possessing the first-mover advantage in the business of excessive stimulus and money printing, having started a couple of decades before the other Western countries jumped on the QE bandwagon. Moreover, Japan has been benefitting from an otherwise very rapidly growing world economy which has enabled it to keep afloat despite its accumulating problems. Now with the dramatically altered external conjunctures, it will be much harder for Japan to maintain even these already dismal macroeconomic figures. Indeed, I would expect a sharp turn for the worse in the near future. Correspondingly, the USA, EU and other Western countries may hardly count on the possibility to drag on their own economic death throes for as long as Japan has been able to do it.