Russian Economy – The disease is not Dutch but Liberal

Russian Economy – The disease is not Dutch but Liberal

6,209 viewsThere has lately again been a slew of articles in the Western business press denigrating Russia’s efforts to develop its industry condemning the drive for import substitution to failure and casting the curse of Dutch disease over it.

I have taken part of these stories just as I was preparing my own article reporting in fact on the success of Russia in these fields. I must say that I am a bit tired of arguing with those witless self-styled experts regurgitating the same old propaganda lines, but nevertheless I decided to take up the challenge and combine my report with a discussion of the Russian import substitution program and the imaginary Dutch disease. The gist of my account is that Russia is not suffering and has never suffered from the fabled Dutch disease, which perhaps is nothing more than an academic platitude to start with. I will explain why I would much rather say that what Russia has been suffering from is something best termed the Liberal disease. While Russia has now largely cured itself from that affliction, it continues to suffer the effects of the Liberal disease, this time in form of being subject to the foolish harangues of Western liberal economists and their stage-managed opposition mouthpieces back home in Russia (or Paris, or wherever they happen to be perched from time to time). – In fact, it is not even as clear as that, because it seems to me that a large portion of the ruling elite, including those in government, are still very much advocating the failed Liberal disease. One gets the feeling that President Putin and his administration is in this respect on the sane pragmatic side whereas the other parts of the government still pull to the liberal side, which is not good at all.

Before I launch into a more detailed discussion on that subject, I would like to set out the facts as they are presently.

Oil & gas share of GDP around 12 to 14 per cent

First there is the persistent misconception about the purported share of oil and gas in the Russian economy. In a recent article in the Forbes titled Despite Weathering Sanction Storm, Russia’s ‘Dutch Disease’ Gets Worse Kenneth Rapoza wants us to believe that the share of oil & gas of Russia’s GDP would following a recent decline be “around 25% to 30%”. We can only lament that such a prestigious business publication as the Forbes allows such a blatant error in print. In fact, the share of oil & gas was 16% as of 2013 according the data from the World Bank. (This can be verified from this link; it gives 18.8% for Russia, but that is the figure of total natural resources, not only oil & gas). There is no official data out on years 2014 and 2015 as of yet, but we too must concede it has declined in the recent years. This is only natural when we consider that the oil price has gone down some two to two and half time while the overall economy is down much less, the combined growth of GDP for 2014 and 2015 being approximately -3%. Deducing from these facts, I would think the present share of oil and gas must be somewhere around 12% to 14%.

The domestic industry has become virtually self-sufficient and exports are diversifying

In general, these people suffer from the incapability of distinguishing between what is a diversified economy and what is a diversified structure of exports. It is the exports that have been dominated by energy, but not the overall economy. The domestic sector is, in fact, amazingly diversified. This is best evidenced by the import statistics following the two years of sanctions warfare and low oil prices. Russia’s imports are nowadays very low indeed. In January 2015, the imports were down a further 18% from last year’s 41%, total down 50% from 2014. The import volume was $8.1 bn (without imports from CIS, which could add one more billion), which is less than 2 times the value that tiny Finland imports with a 30 times smaller population.

This betrays an interesting fact about the charade that Russia has not diversified its economy. How is that, not diversified when the country with 150 million people with a standard of living fit for developed countries lives and function practically without imports? Russian industrial production is slightly down over the two years of crisis, but this is within the big frame of things only a small decrease, which merely reflects the slightly lower consumption, and this mostly due to the punitively high interest rates that the Central Bank maintains. (I have written about this problem here). By and large, all the industries are functioning and developing, and this with minimal import inputs.

Against the barrage of insipid condemnation of the non-diversified structure of Russia’s exports, I have constantly maintained that it is mostly a question of time before such exports emerge. My contention is that Russia’s industrial potential was largely devastated by the end of 1990s, and only after the ascendance of Mr. Putin to the presidency in 2000, there started a reindustrialization. It has then been very natural that the newly emerged industries spent the first ten to fifteen years to satisfy the tremendous need on the domestic markets and hence did not have capacity for exports. As a matter of fact, I do not think that any company ever has started its lifecycle with the export markets, that would be utterly illogical. Exports is not something companies do because it is fun (although some executives for sure enjoy the excitement of business travel), or export so as to satisfy macroeconomic statistics; exports are done when the company is financially solid enough and mature in its product offerings. And it is only now that the young Russian industry is reaching this maturity. I will return to this discussion below with the criticism of dragging in the phony Dutch disease to a discussion of the Russian economy. In the meanwhile, let’s look at some statistics which indeed show that the structure of exports has started to diversify.

The statistics speak for themselves

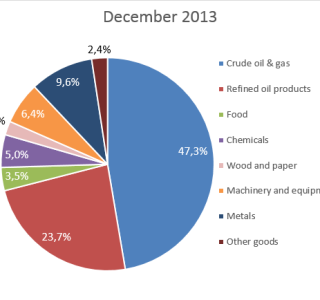

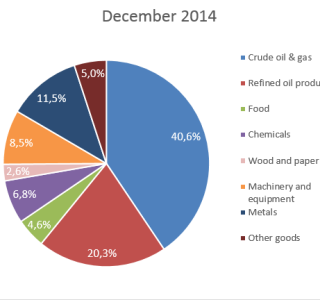

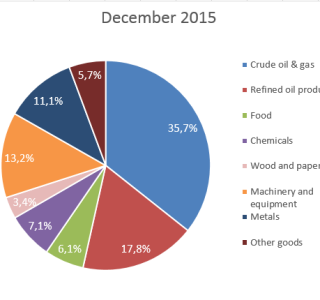

The good news is that Russia is edging towards the coveted state (be it as foolish a dream as it is) where the proportional share of energy exports is rapidly falling as can be seen from the below charts. I have chosen to present the data by giving the monthly statistics for December for each of the years instead of the full year, this in order to more clearly express the dynamics of the change.

The blue area represents export of crude oil and gas, whereas the red (reddish brown) area stands for refined oil products. In 2013 the exports of oil & gas amounted to 70.5% of total exports, leaving 29.5% of all the rest. However, strictly speaking the refined oil products are industrially manufactured goods and should therefore be treated separately from crude oil. Considering this we see that crude oil & gas exports amounted to 47.3% whereas the other exports where 52.6%. By December 2015 the share of the total oil & gas exports had fallen to 53.5%. If again we group refined oil products with manufacturing, then the share of crude oil and gas had fallen to 35.7%, or approximately one third of total exports. All in all the December 2015 pie-chart depicts quite a healthy export structure. What is remarkable is that the share of export of machinery and equipment had reached 13.2%.

Above I qualified the dream (yes, they dream of it) of diminishing the share of energy exports as being foolish. By this, I mean that I do not see any wisdom in such a goal; for sure Russia should sell as much oil and gas it can even if that would equal 90% of the exports. That is not the question, the question is how much in absolute terms Russia exports of other goods and manufactured products. Now, when we look at the presented statistics we see that this lib-dream (lib for liberal and libido) has on first sight so far been achieved mostly through a reduction of the energy exports as opposed to a growth of the other segments. However, that would not be a quite accurate interpretation as it betrays the fact that there has indeed been a significant increase in the physical volumes of the exports of food and manufactured goods. We must understand that the ruble has depreciated some three times to the dollar and yet the dollar value of the non-energy exports remains fairly stable. In this connection, we must remember that the inflation has at the same time been much lesser (about 25% for the years of 2014 and 2015). This then means that Russian companies now fetch vastly more rubles for their exports giving them a healthy profit, which enables further growth and product development. In fact, it is quite misleading to look at the Russian exports and other macroeconomic statistics from the point of view of the U.S. dollar and rarely is this practice applied to other countries.

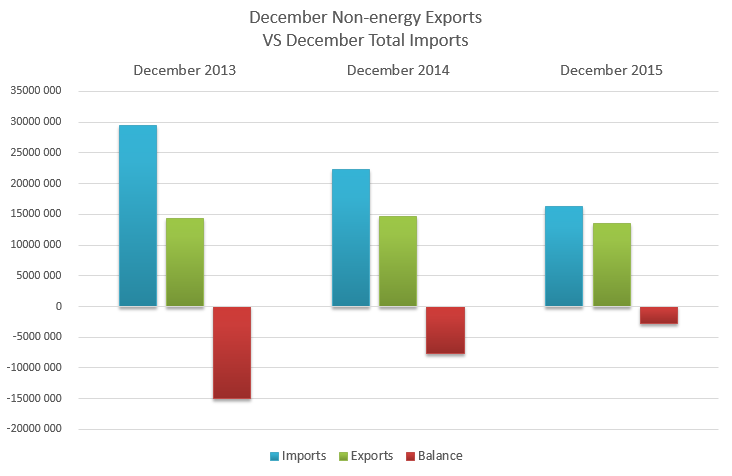

There is something else these export figures show us namely, that Russia indeed has and did have an export industry other than oil & gas. Below charts depict how the gap between these figures have closed so that today the non-oil & gas exports almost fully cover the imports, leaving oil & gas exports to ensure the positive trade balance.

Russia could double its exports in five years

Looking at the development trends of the exports and the industry in general – and the de facto successful import substitution programs of which Alexander Mercouris recently wrote – I see a huge potential for further growth of exports of the non-energy sector. If Russia manages to maintain the present currency parities, that would alone lead to increased exports across all the segments. But, Russia will also get an export boost from concentrated efforts of industrial development. Most importantly, the aviation industry promises to be a huge growth sector with new and renewed planes being rolled out gradually over the next five years (prominently among them the Irkut MC-21). The aviation industry alone could in the next five years add some 50% to the present export volumes (of non-energy). Other new export sectors with big potential are shipbuilding, electronics, pharmaceuticals, and vehicles. With Russia’s recent successful display of its arm’s arsenal on the world scene, we could expect a further boost in that sector also. (Apart from it also serving as an icebreaker for all the other exports). Putting the plough before the sword, the export of food has made considerable strides in recent years, having already overtaken the arms industry in volume, but there is still potential for significant growth in that sector, too. In addition to the raw agricultural commodities, we should expect to see Russia entering the world markets with meat and processed food as well.

Considering all this, I think you do not have to be overly optimistic to expect at least a doubling of Russia’s non-energy exports within five years. At the same time, the present Western exporters have reason to worry. Russia is not the only non-Western country that is on the march, others are also taking market share from the West. One remarkable thing about the Western exports is that most countries are hugely dependent on exports of vehicles, airplanes and pharmaceuticals. They seem to be selling cars to each other. This poses a major risk for those economies. Russia’s and China’s entry into the aviation business should also worry the West, both what comes to the risk of losing market share and ruining their price margins. I would say there is a big question mark with pharmaceuticals as well.

Now, let’s return to the discussion of the misguided idea to apply the Dutch disease on Russia.

There is no Dutch disease

In the above referred article Mr. Rapoza argues that the “Dutch disease, that nasty virus that attacks resource rich countries, is still in Russia’s blood”. However, he provides absolutely no evidence that this would be the case. He does not even refer to a single item of statistics, except for the blatantly faulty claim, which he has plucked from thin air, that the share of oil & gas would be “25% to 30% of Russia’s GDP”. So, in this respect that article is of no interest. It is not any better in other respects either, but it does provide a good sample of the liberal virus that has so permeated Western economic analysis on Russia. One of the syndromes of this virus is that the afflicted person starts to imagine Dutch diseases where there are none.

The term is best explained by The Economist, who coined it in the first place. Here is what they say about it now: “The Economist coined the term in 1977 to describe the woes of the Dutch economy. Large gas reserves had been discovered in 1959. Dutch exports soared. But, we noticed, there was a contrast between “external health and internal ailments”. From 1970 to 1977 unemployment increased from 1.1% to 5.1%. Corporate investment was tumbling. We explained the puzzle by pointing to the high value of the guilder, then the Dutch currency. Gas exports had led to an influx of foreign currency, which increased demand for the guilder and thus made it stronger. That made other parts of the economy less competitive in international markets.”

This actually confirmed my suspicion, you should always be skeptical to these much hyped economic truths (well, in everything, de omnibus dubitandum). See, it is not quite clear that even the original conception of the concept was correct. Maybe there never was a Dutch disease in the Netherlands either? For all, I know the period of 1970s that The Economist in its wisdom refers to coincided with similar adverse conditions across Europe, which can be gleaned from this article. But these kinds of boilerplates are persistent with economists, they love to use them hoping these witty cliches gives the economists the aura of doing real science.

But, whatever, let’s assume that there would have been such a Dutch disease, then the diagnosis would be roughly as follows:

Dutch disease means that when a significant portion of the national wealth is derived from (exports) of a dominant natural resource, then other sectors decline. This would follow from the appreciation of the country’s currency because of the hefty export revenue of this dominant natural resource. Then the nation’s other exports would become less competitive (more expensive) on world markets, while imports become cheaper. Hence the other sectors would be less profitable and receive less investments while the natural resource sector chokes up all the resources.

The only thing of this that is applicable to Russia is that its exports have been overwhelmingly dominated by oil & gas. But none of the suggested consequences hold true for Russia. For sure, the export revenues have affected the domestic price level, to which extent it has done so is however by no means clear. The crux of the issue, anyway, is that the general price level in Russia has all the time remained significantly lower than in Europe and the West, this is verified by the fact that the purchasing power parity of Russia’s GDP has consistently been higher than the nominal. Furthermore, the oil & gas sectors have never employed any significant share of the human resources (around 2% of the workforce). Very tellingly, there has over all the years been a glut of capital in Russia, so much that we have constantly read in the business press about the “Russian capital flight”, which in reality means Russia investing its capital abroad. Thus there has been no shortage of capital for the other sectors. And as it has been demonstrated above, Russia has in fact tremendously developed all the other sectors of the economy, so much so that it is now virtually self-sufficient in all sectors of the economy. As I have pointed out, it is the exports that have not been sufficiently diversified while the domestic industry is so. – In this connection, I refer to a study I authored about the development of the Russian economy from 2000 to 2014. This study also shows how Russia, contrary to the core of the Dutch disease legend, has subsidized the other sectors of the economy by heavy taxation of oil and gas exports while applying relatively low taxes to business in general. In addition, one should consider the saving of the energy profits in Russia’s sovereign wealth funds.

The Liberal disease

Thus, there has been no Dutch disease. What Russia has suffered from is the Liberal disease.

The Liberal disease goes back to Mikhail Gorbachev and the strategy of renewal of Russia’s (USSR) economy under the banner of Perestroika. In fact, I would not blame solely Gorbachev for that disaster. It is my belief that the strategy was conceived by the Soviet elite of the time, including the army and the intelligence services. Gorbachev was merely appointed as the figurehead for that drive. Of course, his hapless leadership exacerbated the disastrous liberal panic reaction that the Soviet leadership had adopted. When we compare the Soviet strategy with that of China we see precisely how totally the Soviet leadership failed in everything. China gradually liberated the market while it retained a strong state and government in form of the party dictatorship. The Soviets on the contrary made lopsided shifts in all aspects: they withdrew the government in form of diminishing the role of the Communist party and security services, but not fully, the carcass of it still stayed formally in power. The result was anarchy. They freed the markets, but only for the criminals. They totally neglected investments to modernize the industry, and let the assets and cash streams be openly or covertly stolen by insiders and the mob. The result was total chaos and the breakup of the Soviet Union.

Then in 1991 Boris Yeltsin came to power in Russia and was unfortunately surrounded only by crooks and liberals. The latter pushed Russia to the most devastating economic and human experiment in history aptly called the “shock therapy”. What followed was a ruinous and deep-rooted anarchy. Obviously, it was not feasible to invest in industry, modernization and diversification under those conditions.

Thus, Russia suffered for 15 years since Gorbachev to the end of the Yeltsin period in 2000 not under any Dutch disease but the Liberal disease.

When Vladimir Putin finally took over in 2000, Russia’s economy and industrial base was utterly devastated. And only, from this point on can we analyze the development of the Russian economy in any intelligent economic terms. Comparing Russia’s conditions of anarchy with the Dutch conditions or those of any other country, which has benefitted from an orderly social and economic historic development is utterly nonsensical.

With a gradual decrease in the weight of the liberal ideology, things have rapidly improved in Russia, and we have the impressive results of which I presently report. But, I stress, there has been only a gradual decrease in the Liberal disease, much remains to do for Russia to fully enter a sensible and pragmatic, non-ideological development trajectory.

What is most important in all these analyses is time. Always consider the time frame. 15 years is short for kickstarting an industry from scratch and two years is short for fundamental results in import substitution. Whoever pretends to be an economist and ignores the time factor is just a charlatan.

Would you like to share your thoughts?

Your email address will not be published. Required fields are marked *

0 Comments