Doing Business in Russia; a Snapshot of Logistics Services

Doing Business in Russia; a Snapshot of Logistics Services

476 views Two recent blog posts have presented an overview of the logistics environment in Russia with more detailed information on the efficiency of transport infrastructure and customs procedures. These mainly relate to the public sector. However, from a business point of view logistics services are mainly provided by companies (logistics service providers – LSPs) or produced in-house. That is why we wanted to present to you, next, some aspects to logistics services in Russia from the performance perspective based on the Logistics Performance Index (LPI), developed by the World Bank. In next week’s blog we will move on from the, albeit important, logistics topics, onto other areas of the Russian business climate.

Two recent blog posts have presented an overview of the logistics environment in Russia with more detailed information on the efficiency of transport infrastructure and customs procedures. These mainly relate to the public sector. However, from a business point of view logistics services are mainly provided by companies (logistics service providers – LSPs) or produced in-house. That is why we wanted to present to you, next, some aspects to logistics services in Russia from the performance perspective based on the Logistics Performance Index (LPI), developed by the World Bank. In next week’s blog we will move on from the, albeit important, logistics topics, onto other areas of the Russian business climate.

1) Ease of arranging competitively priced shipments

What is important to understand is that logistics is a huge business in terms of money and volume, both locally and globally. In 2010, the annual expenditure estimate on logistics services in Europe was 930bn. euro. This figure includes all in-house and outsourced logistics services costs related to transport, storage, transshipment, inventory holding, order picking and processing, as well as planning/management. All LSPs are trying to make a profit but also competition is fierce so most of the time there is opportunity for tendering… When it comes to the ease of arranging competitively priced international shipments, Russia’s scoring compared to other high-income countries is somewhat lower, 2.64. In 2014, the average costs for logistics exporting in Russia (to port or airport) were 1,225 USD, while the corresponding figures for import were 1,732 USD. For instance, in Germany these figures were 675 USD (import) and 892 USD (export).

It is not a straightforward matter to identify one particular reason for this, but some aspects may include the liberation of markets and privatization of LSPs. These took place rather early in Europe and in the US, which have boosted competition and thus lowered prices. In any case, if you are shipping unitized cargo (e.g. parcels and containers) you should be able to find several options to tender out. Due to its geographical location, Russia has some interesting alternatives for shipping by sea between Europe and Asia. For example, several large multinational companies have partnered with freight forwarding firms and railway undertakings in Europe, Russia, and Central Asia to establish regular routes between EU and China through Kazakhstan. Namely the New Silk Road.

2) Competence and quality of logistics services

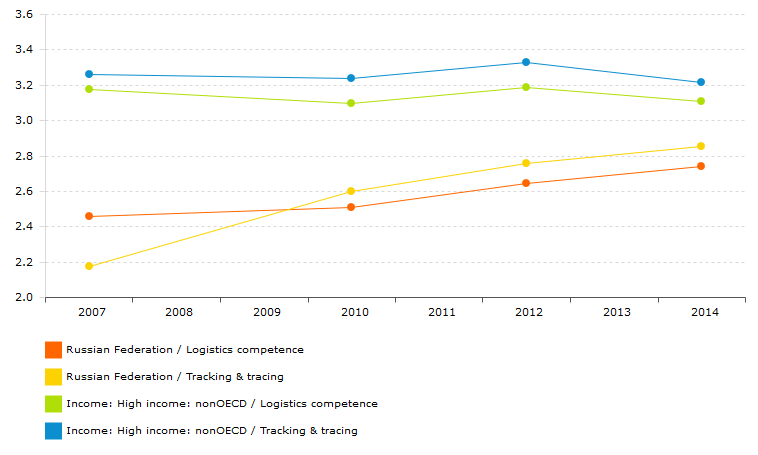

As mentioned above, companies may choose to arrange logistics services in-house or outsource these to LSPs. Competence and quality of logistics services covers different service providers like transport operators and customs brokers. Compared to the reference group of high-income non-OECD countries, Russia is behind average but improving its scoring as illustrated in the figure below.

3) Ability to track and trace consignments

The importance and need of tracking and tracing consignments varies between industries. The higher the value/volume ratio is the more important is the ability of tracking. As it is with logistics competence, cargo tracking and tracing abilities are developing in Russia, and the gap to other countries is narrowing down. As a matter a fact, the scoring of this ability as improved from 2.17 (2007) to 2.85 in just seven years (Figure below). One example of initiatives to improve traceability of cargo is Russian satellite navigation system GLONASS (Global Navigation Satellite System) which provides platform for location-based services from tracking to road tolling.

Full data http://lpi.worldbank.org/

4) Timeliness of shipments

Together with other aspects, the timeliness of shipments defines the quality of logistics services. This is measured by the frequency with which shipments reach consignees within scheduled or expected delivery times. This category gives Russia the highest scoring out of all LPI subareas, 3.14. The export statistics shows that the average distance to port or airport was 286 kilometers and the lead-time was two days. These figures are surprisingly small considering the distances in the country. Considering the land supply chain, the average distance was considerably greater, 3,500 kilometers, and average lead-time was 11 days. These figures should be taken neither negative nor positive, but rather as an indication of the local logistics environment.

Last three blog entries have discussed Russia’s logistics environment from several perspectives. As the indicators have showed it, several steps have been taken forward; however, there is still room for improvement. For companies that operating in Russia, these are things worth keeping in mind when designing and building a supply chain. One can find both local LSP as well as global express couriers providing their services in Russia. At the same time, it is equally important to cope with regulations, especially when it comes to import or export.

As usual in business, another key to successful logistics performance is collaborating with the right companies. Awara is ready to serve you with our local expertise and networks – also when it comes to building a successful supply chain.

Would you like to share your thoughts?

Your email address will not be published. Required fields are marked *

0 Comments